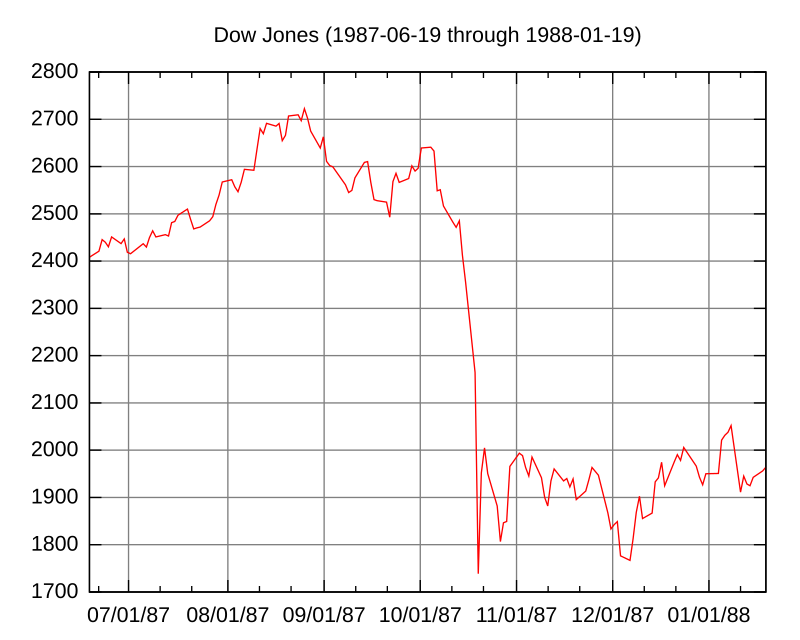

October 19, 1987, is etched in history as the infamous ‘Black Monday,’ a day when the stock market was rocked by its most severe one-day percentage drop. The Dow Jones Industrial Average nosedived by over 22%, triggering a wave of shock and fear of a looming financial catastrophe that reverberated across global markets.

Interesting Facts:

- On Black Monday, the Dow Jones Industrial Average dropped by a staggering 508 points, a 22.6% decline in a single day. This remains the most significant one-day percentage loss in the history of the U.S. stock market.

- The crash was caused by a combination of factors, including computerized trading programs, investor panic, and economic uncertainties leading up to the event.

- The repercussions of Black Monday were not confined to the US. Global markets, including major UK, Japan, and Hong Kong stock exchanges, were also jolted by significant declines, turning it into a full-blown worldwide financial crisis.

- Despite the initial panic and fears of a prolonged recession, the US economy bounced back relatively quickly. This was largely due to the decisive intervention of the Federal Reserve under the leadership of Chairman Alan Greenspan, who injected liquidity and encouraged banks to keep lending, thereby restoring confidence in the markets.

- The crash led to significant changes in market regulation. One of the most notable reforms was the introduction of “circuit breakers”—mechanisms that temporarily halt trading if the market drops too sharply in a single day.

- Many investors feared Black Monday could lead to another Great Depression, but decisive government intervention and market adjustments helped stabilize the economy.

- Black Monday continues to be studied in financial and economic circles. It serves as a stark reminder of the risks associated with market speculation, computerized trading, and the crucial role of regulatory safeguards.