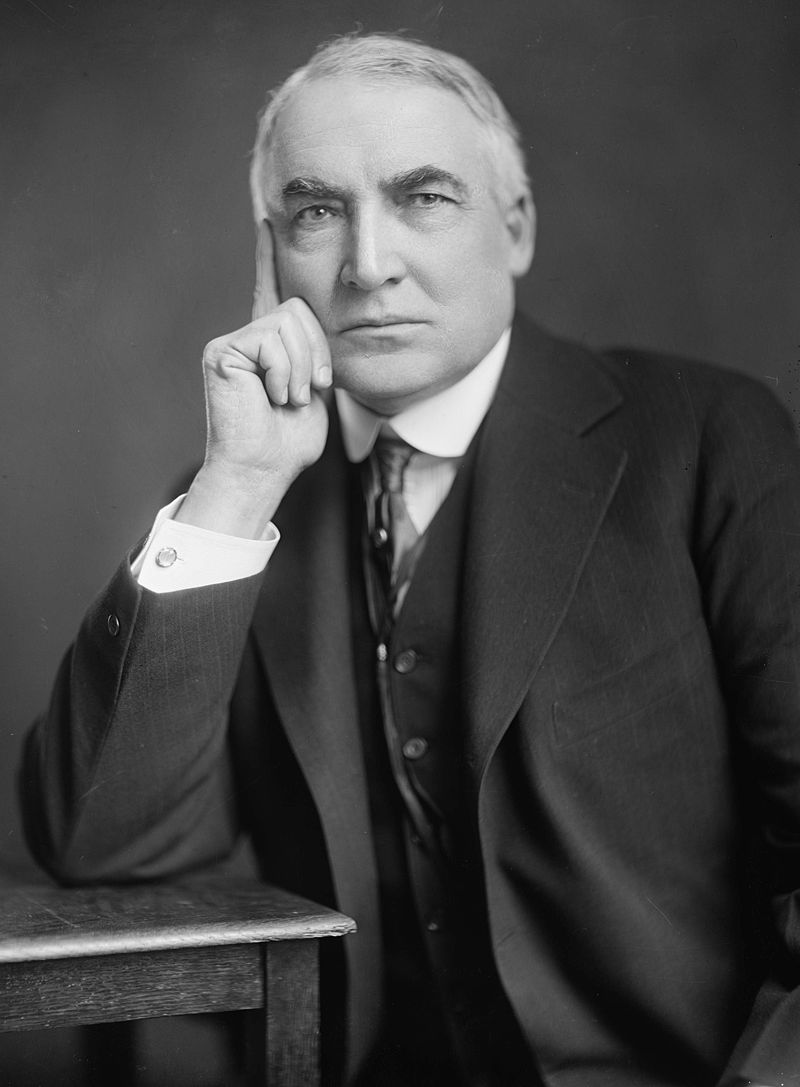

Americans did not pay federal income tax at the turn of the twentieth century. Since the repeal of President Lincoln’s wartime tax in 1872, Americans who lived in urban regions had become used to no federal income tax, especially the tiny percentage of Americans that earned the most significant incomes. However, the American landscape was changing as a massive shift in population led to more people living in cities than on farms and rural towns. By July 1909, Congress had passed the 16th Amendment to the U.S. Constitution. Though ratification took another four years, all Americans were then required to pay federal income tax. In the year after the 16th Amendment took effect, about 1% of Americans paid federal taxes. The current president should have paid taxes because of the salary arrangements. Finally, on March 14, 1923, President Warren G. Harding became the 1st U.S. President to pay taxes, a moment that marked a significant shift in the country’s tax history and the beginning of a new era.

The journey from the well of Congress to official Constitutional Amendment status was challenging. Though it’s specifically difficult to amend the Constitution, the 16th Amendment had more challenges than most on its way to history. There was fierce resistance by the conservatives in Congress toward any federal taxes. High-wealth income earners must pay the federal government large chunks of their earned wealth. This was the age of robber barons, a term used to describe the powerful industrialists and financiers of the late 19th century, where political forces worked to help people keep the federal government out of their working lives. However, underneath the silk and gold leaf, powerful progressive movements were gaining momentum, advocating for a federal graduated tax scheme and massive expansion of the federal government, which was just around the corner.

In a classic case of ‘careful what you ask for,’ the minority party in Congress proposed a constitutional amendment to address the country’s growing wealth disparity. This amendment would require all Americans to pay income tax. Many viewed this as a gimmick, believing there was no way to achieve the necessary three-fourths majority for state ratification. After all, they thought, surely there would be enough people who would oppose paying federal taxes. However, the unexpected happened, and the 16th Amendment was successfully ratified, marking a significant turning point in U.S. tax history.